At Mr Lender, we offer short term loans between £200-£1,000.

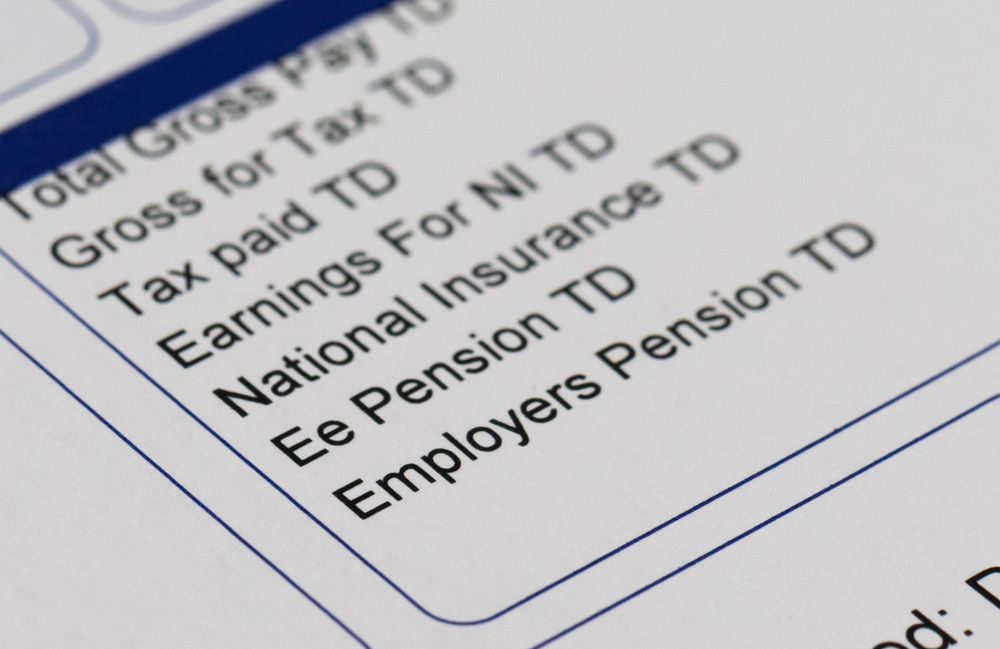

If you’re currently in employment or have been in the past, no doubt you would’ve come across a payslip at some point or another. A payslip is an essential part of your employment and should help you to understand and manage your money – but just what is a payslip? What does all the information mean on one and how do you know if it’s all correct? This post from Mr Lender aims to help you to understand your payslip, and to define some of the words you may come across when looking at one.

What is a payslip?

A payslip is a note provided to an employee, outlining details such as the amount they’ve been paid for a particular period, as well as the amount of tax deducted. A payslip can be in either paper or digital format, and may be sent via email or post.

According to Gov.uk, your employer must provide you with a payslip according to your employee rights. The only time your employer is not required to provide you with a payslip, is if you’re in the police service, a merchant seaman, you work in share fishing, or you work as a contractor or freelancer.

What must a payslip show?

There are a number of things which an employer is required to include on a payslip, including the gross pay, net pay and any tax deductions. The gross pay is the full amount paid to the employee before any tax or National Insurance has been deducted. The net pay therefore is the amount being paid to the employee after tax and National Insurance deductions have been taken into account.

It is a requirement for your employer to outline any tax deductions on your payslip – however it isn’t a requirement for your employer to always leave a description of what they are. It is only a requirement for your employer to leave a description for any variable tax deductions, such as income tax and National Insurance. Any fixed deductions, such as union fees, don’t need to have a description explaining what the deductions are for, as long as your employer provides you with a separate statement at least once a year.

It is also a requirement for your employer to outline the amount and method for any part payments which you may receive. For example, if your employer pays you part of your wages in cash and the rest into your bank, this needs to be outlined on your payslip.

Optional information included on a payslip

In addition to all of the above requirements, there is also some optional information which your employer may choose to include, such as your tax code, National Insurance number, pay rate, and any additional pay including overtime and bonuses. It isn’t compulsory for your employer to list this information on your payslip, however you may see it anyway.

Payslip definitions

When it comes to understanding your payslip, there is often quite a lot of jargon included which may be a little difficult to understand. These definitions may help you to understand your payslip a little easier:

Payroll number

Some companies – particularly larger ones – will allocate each employee a payroll number. This helps to identify individual employees when going through the payroll. You may see this number appear on your payslip, but it is more for admin purposes so you shouldn’t need to pay too much attention to it.

Tax code

When starting a new job, you will be allocated a tax code based on the circumstances of your employment. Whether you’re employed full time or part time, or if this is a second or third job, a different tax code will apply. The code is also based on how much you’re paid too. It is important for you to check your tax code as an incorrect one could mean you end up paying too much or not enough tax. If this is the case, you will usually receive a letter from HMRC – if you have overpaid on your tax, you may also receive a cheque as a tax rebate.

Understanding your tax code

Tax codes are often made up of a letter followed by a series of numbers. You can work out your tax code using the following information:

- BR – means the basic rate of tax for a second job or pension

- D0 – is the tax code for all income from a second job or pension taxed at the higher rate

- D1 – is the tax code for all income from a second job or pension taxed at the additional rate

- L – for all income taxed at the basic, higher and additional rates

- M – for all income taxed at the basic, higher and additional rates when a spouse of civil partner has transferred over some of their personal allowance

- N – for all income taxed at the basic, higher and additional rates when it is the employee who has transferred some of their personal allowance to a spouse or civil partner

- NT – no tax deducted – this is for very specific cases, such as musicians who are regarded as self-employed and are not subject to PAYE

- S – for Scottish tax rates

- T – for all income taxed at the basic, higher and additional rates, “when HMRC needs to review some items with the employee”

The number part of the tax code is the amount of tax free income you receive before paying tax. The number is then divided by 10 to get the correct code. Anyone earning below £123,000 annually will often qualify for a personal allowance of £11,500.

So for example, somebody with only one job being taxed at the basic rate, who also has a tax free allowance of £11,500, will have the tax code L1150.

What to do with your payslip

Once you receive your payslips, it is advised that you keep them in a safe place. The first reason for this is to prevent identity fraud. If an identity thief managed to get a copy of your payslip, they will have access to crucial information such as your name, address, National Insurance number and – potentially – your bank details. You may want to destroy any old payslips to prevent this situation from occurring, however you should make sure the document has been destroyed entirely to prevent an identity thief from reassembling your payslip.

Another reason to keep a hold of your payslip is for record keeping purposes. If you face problems with your pay one month, it is always good to have a payslip available to refer to. It may be that you have been paid too much, or not enough – having a payslip handy will help to prove your point.

One final reason for keeping your payslip is to act as evidence of earnings. Some products, such as short term loans, mortgages and car finance, may require a copy of your payslip to prove you are in employment and that you can afford to pay them back. Some companies may even require a few months worth of payslips as evidence of earnings.

Mr Lender is a multi-award winning lender and is rated five stars on Trustpilot by customer reviews. So why would you choose anyone else for your short term loans?