Published: 19/03/2021

and written by P Smith

With over five million people using buy now, pay later services in the UK last year, the chances are you’ve heard about the latest credit craze. But are you confident that you know how they work and of the consequences of not repaying on time? Here at Mr Lender, we’ve provided a guide to explain what buy now, pay later services are.

Buy now, pay later (BNPL) is a form of store finance where customers spread the cost of a purchase over a period of time – this is usually in monthly instalments. The BNPL industry has received a lot of press recently, both positive and negative, as younger people are increasingly beginning to use it through companies such as Klarna, Clearpay and Laybuy.

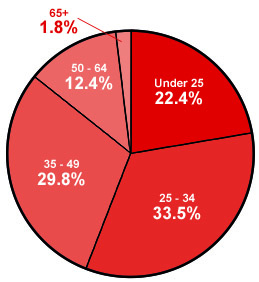

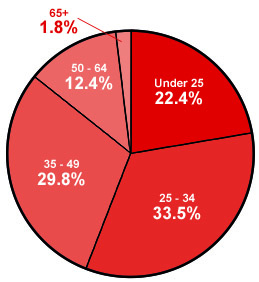

With just under 23% of users aged between 18-24 and 34% of users aged between 25-36, there are strong arguments that younger people have never been more tempted by a form of credit and perhaps aren’t fully considering their options before signing up.

THE GOOD

Spread payment for an item

The main benefit of BNPL is the ability to not pay the entire sum for an item upfront. This can be really useful for emergency situations that would leave a big dent in your bank balance in one hit. For example, if you needed an appliance at home such as an oven, you may be able to spread the cost over three months instead of paying the full amount in one transaction and therefore potentially softening the financial impact a large purchase would have on your finances.

Soon to be regulated

The FCA have recently announced the BNPL sector will be falling under their regulatory remit. Being regulated by the FCA can only be a positive for consumers, with customers soon being able to use the Financial Ombudsman Service should they feel dissatisfaction with the service they received. |

THE BAD

Debt can pile up

A common issue with BNPL is what might seem as a one-off way to purchase an item can easily turn into a debt habit. There have been multiple cases of people who continue signing up to spread the costs over monthly instalments and suddenly lose track of how much they’re actually spending. It can be very difficult to keep up with how much you need to pay each month once multiple purchases have been made this way and you can quickly find yourself in an unsustainable level of debt without even realising. It’s too often the case where BNPL credit is undertaken as an instinctive decision (e.g. a notification in the checkout process when shopping online or the cashier in a store offering it before paying) whereas in reality, it should be a carefully considered proposal – as with any form of credit.

Can have a negative effect on your credit report

Something that many people, especially those who are younger, may not consider is the effect it can have on your credit report. If you’re slightly older, the chances are you’ve had some experience in dealing with a credit score whether that’s for a mortgage or credit card, but BNPL services are some people’s first line of credit they’re undertaking. A higher credit score can have numerous benefits later on in life and what’s not always made clear is that missing a payment can have a negative effect on a customer’s credit score which is something everyone should consider before taking out any form of credit including BNPL. Additionally, a missed payment doesn’t usually just result in your credit score being affected, many BNPL providers will also charge a fee or interest for missed or late payments. Again, this may not be something the customer has budgeted for and may put them further in debt without intention.

|

THE UGLY

Is BNPL right for you?

BNPL isn’t a new concept however the transformation in the way it’s been marketed in recent months and years has not been without its controversies. With the FCA feeling the need to step in, there have been questions asked if the checks being carried out by some providers are sufficient to ensure that this form of credit is right for the customer’s individual circumstances. For example, the FCA review into the sector found that one in 10 people who had used BNPL services, already had debt arrears elsewhere and therefore their most recent purchase had further increased their burden of debt.

Use of social media and influencers

With the evolution of social media as a key advertising platform, BNPL providers can reach potential new customers in ways never available previously. As advertising methods continue to develop and expand, the role of social media influencers has never been more rampant. Many influencers have a younger following at their core and some BNPL providers have been utilising their large followings in recent months to increase awareness of their services – with the Advertising Standards Agency recently banning ads from a leading BNPL provider for their “irresponsible encouragement of the use of credit to boost a person’s mood…”. Recently, some influencers are starting to question whether promoting BNPL services is right for them and their following based on a “lack of clarity about how the service operates – and its potential drawbacks”. This is something the FCA will likely be looking to clampdown on as making credit look ‘cool’ could result in tempting young people into taking out credit for the wrong reasons or where it’s not suitable for their circumstances. |

|

Mr Lender is a multi-award winning lender and is rated five stars on Trustpilot by customer reviews. So why would you choose anyone else for your short term loans?